The best ever marketing tool for accounting professionals, since the ancient Egyptians started record-keeping for their royal storehouses, are – referrals! Acquiring clients through referral is a technique as old as the pyramids!

A referral is simply a recommendation from a person, usually one of your previous or existing clients or colleagues, to another person to use your services.

Why referrals are so important for your accounting practice?

For any business – be it small or large – choosing the right accounting partner is an important decision. As their accounting advisor, you’ll gain intimate knowledge about their business and their personal financial goals as well. So, an established reputation and trust are highly critical for people to move their business to you.

When someone refers to you, they are vouching for you. And it is far more persuasive when someone else sings your praises than you try to do it yourself!

Do you know where the most persuasive advertising comes from? It’s from the people we already know and trust!

According to Nielsen’s Global Trust in Advertising Report

“More than eight-in-10 global respondents (83%) say they completely or somewhat trust the recommendations of friends and family.”

In another research done by Hinge Marketing, 87% of participants said they ask friends or colleagues when they are looking for an accountant.

So, it’s pretty clear how much important referrals are for your accounting practice. Question is – what you need to do to get those referral clients?

Identify Your USP (Unique Selling Proposition)

As stated in Entrepreneur.com encyclopedia, the definition of the Unique Selling Proposition (USP) is:

“The factor or consideration presented by a seller as the reason that one product or service is different from and better than that of the competition”

But what it really stands for? How can it help your accounting practice to get more referral clients?

A unique selling proposition is what your business really does or cares or stands for. It’s what makes your business stand out among other similar types of business. Instead of trying to stand for everything, a business with a USP is known for something very specific.

Let’s explain further.

Many accounting professionals try to offer every possible service they can when they get started. But when you try to be well-known for everything, you become known for nothing! You can’t offer everything to all people!

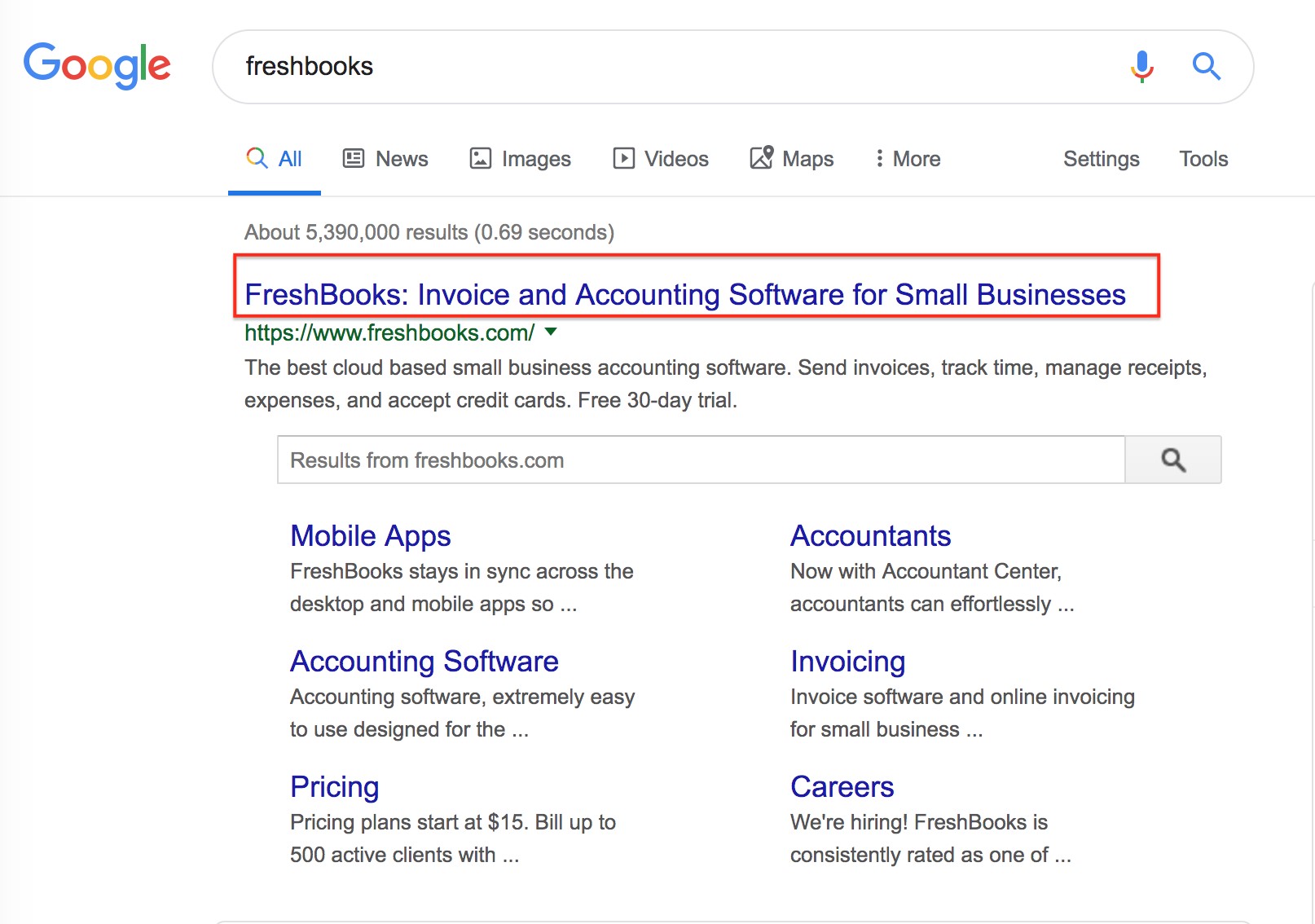

We can look at FreshBooks as an example. If you search on google just by writing Freshbooks, the following will appear.

Do you notice what they stand for? They say “Invoice and Accounting software for Small Businesses” – not medium or large businesses. This is done on purpose.

Instead of trying to be an accounting software for every business out there, they just focus on serving small businesses. A whopping number of 24 Million people have used FreshBooks so far and they have paying customers over 160+ countries!

The point – you need to be very specific about what you’re offering instead of running a generalized accounting practice.

You can be industry specific (plumbing, constructions, etc) or service specific (bookkeeping, tax return, etc) based on your preference and expertise.

You need to identify your USP for which people will remember you for. When you do that, you will get more referral customers because your good friends will easily understand what you really do and whom they could refer to you.

Market Your USP

Identifying your USP is one thing, ‘marketing it’ to your target customers is quite another.

Once you come up with your USP, you need to show off and reach out to your potential customers with that. This is how:

Your tagline: If your business name is ABC Accounting Service, and you plan to center your service to retails, then your tagline (the words used under the business name and/or logo graphic) could be “Accounting Solution for Retails.”

Your Branding: Your USP should be reflected in all your branding materials. For example, you might create a graphic of an official seal with ’Accounting Service for Retailers’ and position it on your website, on the cover of your brochure, or at the side of your business card layout.

Your email signature and voice-mail message: We tend to forget or ignore this one. But when you use your USP in your email signature and voice mail messages, it could bring you the fortune at the cost nothing!

Verbal introductions: When you meet someone new or you are at a networking event, introducing your USP could engage others and gauge their interest in what you do.

There’s just one catch!

Market demand and your competitors’ offerings will get changed, so is your own business and competitive edge. Hence, while thinking about your USP and its promotion, keep in mind that your tagline and look and feel are easier to change when necessary than your logo or business name.

Incentivise Your Referral program

People love receiving gifts. When you send your happy clients ‘surprise gifts’ – that helps increase the likelihood that they’re going to refer someone else to you.

You can provide a financial incentive for every good referral that ends up signing up with you. However, many people may not accept or feel uneasy with direct cash rewards. In that case, you can provide other incentives that make more sense for you and your accounting firm, such as:

- Gift Cards to your client’s favorite restaurant or coffee shop

- Visa gift cards

- Movie tickets

- A favorite bottle of drink

If you’re not sure of what to gift, JUST ASK!

You can ask your clients what their favorite drink is, and if they say coffee, you can ask where they love to go for coffee. Then, hop online and get them a gift card or send them a packet of their favorite coffee beans.

One important note: There might be regulations as to how large a gift you are allowed to give and your clients are allowed to receive. So, make sure your gift is legal so that NO ONE gets in any trouble!

Cross Sell/Exchange Referral Programs

You can partner up with other professionals who serve the same target group as you do, but with different services.

You can tap into your professional networks, search LinkedIn or leverage local networking groups like business associations and clubs to identify such professionals who already serve the customers that you want to serve. This could include a management consultant, a lawyer, an insurance agent, a banker or anybody you think has a genuine customer base.

The partnership could be in different models. You can pay each other direct referral bonus or you could offer special rates or discounts for each other’s customers.

Conclusion

Many of the accounting professionals are shy of asking clients for referrals. But the interesting part is – according to a marketing survey done by Texas Tech – “83% of satisfied customers are willing to refer a product or service. But only 29% actually do”.

So, getting more referrals could be as simple as asking your clients to refer others to you!

There’s just one problem… if you want to attract referral clients, you need to create a service level that people can easily hook on others to it!

No negative vibes – but do you know how one starts smoking? By hanging with other smokers who seem to have a great experience out of it! If you can maintain high quality and integrity and provide a great service to your clients, people hanging around your clients will certainly know about your accounting practice and start ringing your doorbells.

What other ideas could we use to generate more referral clients? How do you generate referrals for your business? Please share your experience below.